Back

Property Tax: Definition, What It's Used for, and How It's Calculated

Written by:

Richard Shaw

June 3, 2024

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

Property tax is a levy imposed by the government on property owners based on the value of their property. Property taxes are collected by state and local governments as one payment to fund various public services and infrastructure. It accounts for 36% of all state and local tax revenue.

Purpose of Property Tax

Property tax funds the local services we rely on every day, including schools, libraries, and parks, police, fire departments, and emergency services, infrastructure maintenance, roads, bridges, and public transportation systems.

How Property Tax Is Calculated

Property tax is calculated as (tax rate) x (property value). The tax rate is set by the local government and the property value is set by a local government assessor who evaluates the market value of the property based on various factors, including location, size, and condition. Property tax rates range from as low as 0.18% in Louisiana to as high as 2.4% in Rochester.

Finding your Property Tax Rate

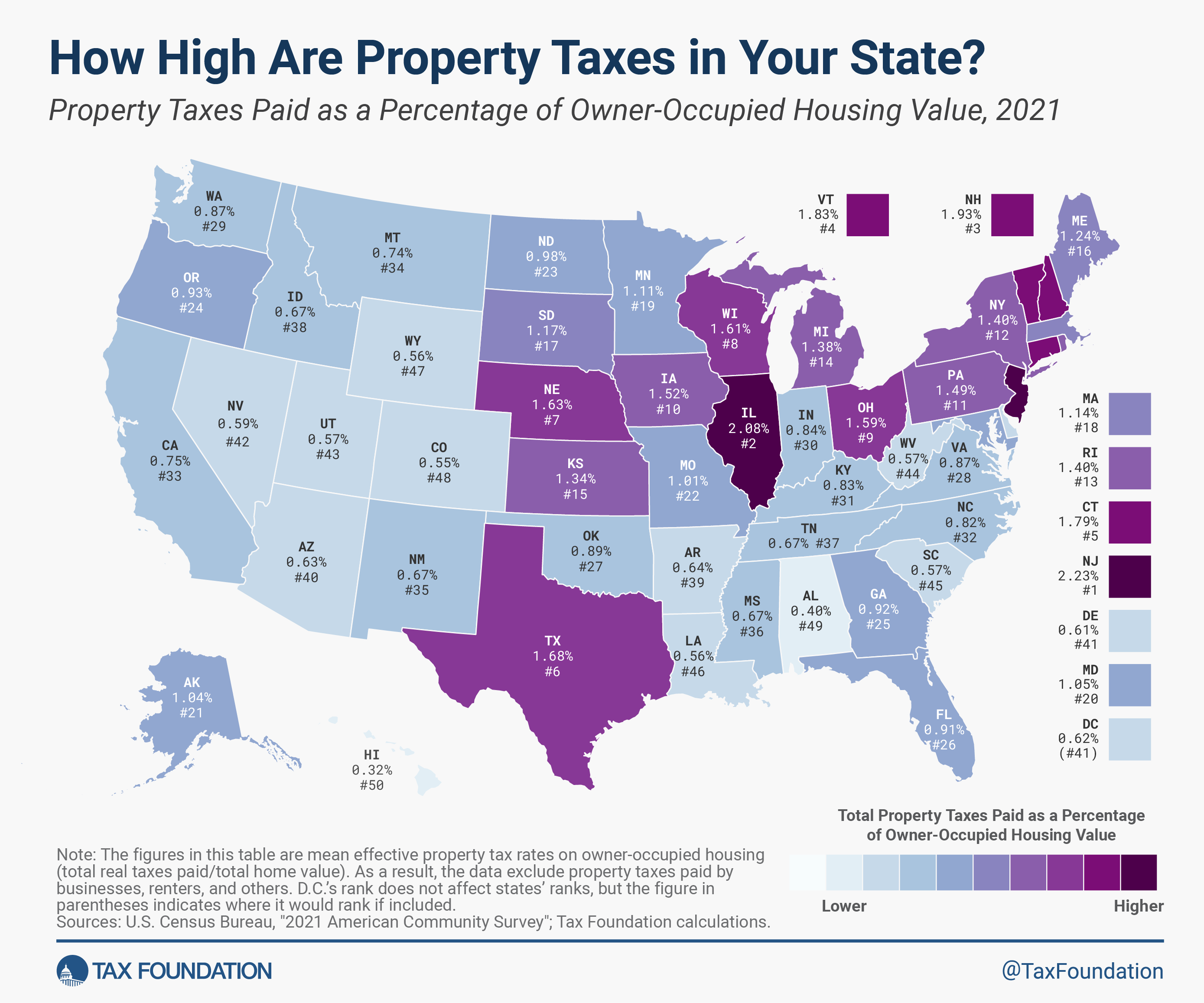

Your specific tax rate will be found on your municipal government website but you can use this map to see the average for each state.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.