Back

Nottingham Short-Term Rental Regulation: A Guide For Airbnb Hosts

🤔 Confused? Get your vacation rental license, tax registration and inspections done for you

Disclaimer: This article is for informational purposes only and not legal advice. Regulations could have changed since this article was published. Check local zoning authorities and consult a legal professional before making any decisions.

⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.

What are Short-Term Rental (Airbnb, VRBO) Regulations in Nottingham, UK?

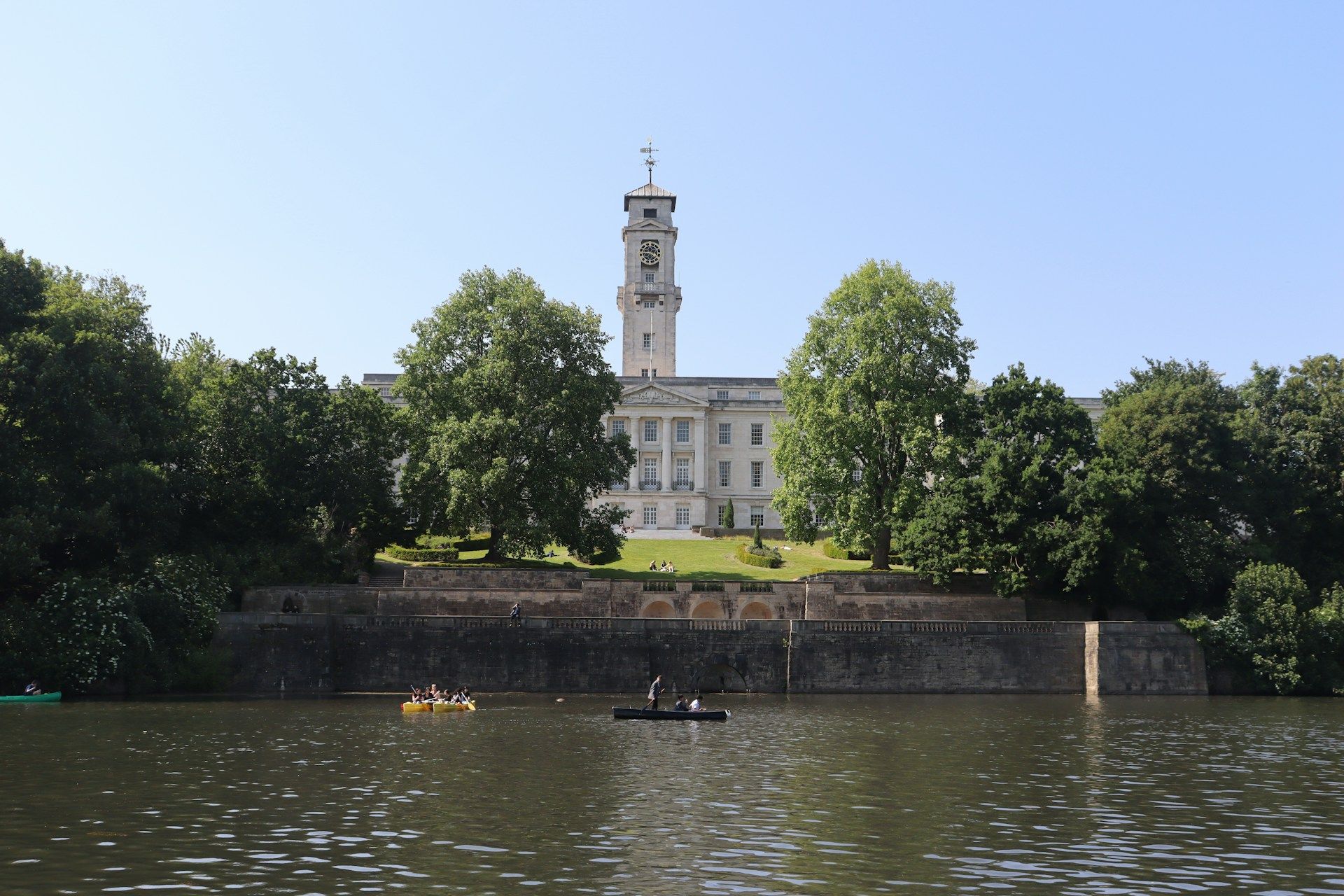

Nottingham is a popular tourist destination in the East Midlands region of England, known for its rich history, cultural attractions, and association with the Robin Hood legend. As the short-term rental market has grown in the city, it's important for hosts to understand the local regulations governing Airbnb and VRBO properties. Here's an overview of the key rules and requirements:

Starting a Short-Term Rental Business in Nottingham

To operate a short-term rental in Nottingham, you will need to ensure your property complies with all relevant health and safety standards, as well as specific local regulations:

- Planning permission is generally not required to rent out a property on a short-term basis in Nottingham, as long as the property remains primarily a residential dwelling. However, it's always a good idea to check with the Nottingham City Council planning department to confirm your specific circumstances.

- If your property is a House in Multiple Occupation (HMO) shared by 3 or more unrelated people, you may need an HMO license from the council. This applies to properties located within Nottingham's additional licensing areas.

- All short-term rental income must be declared for tax purposes. You may be eligible for certain tax reliefs, such as the £7,500 per year Rent-a-Room scheme if renting out a room in your main home.

- Ensure your property meets all required health and safety standards, including having working smoke alarms, carbon monoxide detectors, and gas and electrical safety certificates.

- If you plan to rent out your property for more than 140 days per year, you may become liable for business rates instead of council tax.

One Nottingham Airbnb host shared this advice on the Bigger Pockets forums:

"Make sure you do your homework on the local regs, especially things like HMO licensing and health and safety compliance. It's also a good idea to introduce yourself to the neighbors and provide them with contact info in case any issues come up with guests."

Other Considerations

- While Nottingham doesn't currently have a citywide permit or registration system for short-term rentals, this could change in the future as the market grows and the council monitors impacts on housing and communities.

- Short-term rental hosts can join voluntary accreditation schemes like the Nottingham Standard to demonstrate their commitment to high standards and responsible hosting practices.

- Hosts should carefully review their mortgage, lease, and insurance terms to ensure short-term letting is permitted. Some policies may have restrictions or require additional coverage.

By following the regulations outlined here and prioritizing guest experience, hosts can tap into this thriving market and build successful short-term rental businesses in Nottingham.

Required Documents for Nottingham Short-Term Rentals

To operate a short-term rental in Nottingham, you will need to ensure you have the following documents in order:

- Gas Safety Certificate: If your property has any gas appliances, you must arrange for an annual gas safety check to be carried out by a Gas Safe registered engineer. You must provide a copy of the gas safety certificate to your guests before they check in.

- Energy Performance Certificate (EPC): All rental properties in England and Wales must have a valid EPC, which provides information about the property's energy efficiency. EPCs are valid for 10 years and must be obtained from an accredited domestic energy assessor.

- Electrical Installation Condition Report (EICR): Landlords are required to ensure the electrical installations in their rental properties are safe. An EICR must be carried out by a qualified electrician at least every 5 years.

- Portable Appliance Testing (PAT): Any portable electrical appliances provided in the rental property, such as kettles, toasters, and lamps, should be regularly tested for safety by a qualified electrician.

- Furniture and Furnishings (Fire Safety) Regulations: All furniture and furnishings provided in the rental property must comply with the relevant fire safety regulations. Look for appropriate labels on items to ensure compliance.

- Legionella Risk Assessment: Landlords are responsible for assessing and controlling the risk of Legionella bacteria in the property's water systems. A risk assessment should be carried out by a competent person and reviewed regularly.

- HMO License: If your property is a House in Multiple Occupation (HMO) shared by 3 or more unrelated people, you may need to obtain an HMO license from the Nottingham City Council. Check the council's online map to see if your property falls within an additional licensing area.

- Planning Permission: If you have made any structural changes to your property or changed its use (e.g. from residential to commercial), you may need to obtain planning permission from the council.

- Insurance: While not legally required, it is highly recommended to have appropriate insurance coverage for your short-term rental property, including public liability insurance and contents insurance.

By ensuring you have all the necessary documents and permissions in place, you can operate your short-term rental in Nottingham with confidence and in compliance with local regulations. The Nottingham City Council's website provides detailed guidance for landlords on meeting their legal obligations.

Short-Term Rental Licensing Requirements in Nottingham

Currently, Nottingham does not have a citywide licensing or registration system specifically for short-term rentals. However, certain types of properties may require licenses:

- If your property is a House in Multiple Occupation (HMO) shared by 3 or more unrelated people, you may need an HMO license from the Nottingham City Council. This applies to properties located within the city's additional licensing areas, which cover most of the central neighborhoods.

- To determine if your property falls within an additional licensing area, check the council's online map or contact the HMO team directly.

- HMO license applications must be submitted online through the council's website. The application fee is £1,330 per property, plus £120 per habitable room.

- The council aims to process HMO license applications within 12 weeks of receiving a complete application and payment. Once issued, the license is valid for 5 years.

- Failure to obtain a required HMO license can result in fines up to £30,000, prosecution, and rent repayment orders. The council may also issue interim management orders and take over management of unlicensed properties.

While Nottingham doesn't currently require licenses for all short-term rentals, the city council is actively monitoring the sector and has the power to introduce additional licensing requirements if deemed necessary. One local host on the Money Saving Expert forums noted:

"I've been running an Airbnb in Nottingham for a few years now, and so far the council hasn't required any special licenses beyond the normal HMO stuff. But I wouldn't be surprised if they start cracking down more in the future, especially in the city center where there are a lot of short-term lets popping up."

Other Permits and Regulations

In addition to HMO licensing, short-term rental hosts in Nottingham should be aware of other potential permit requirements and regulations:

- If you plan to make structural changes to your property or change its use (e.g. from residential to commercial), you may need planning permission from the council.

- Properties with shared facilities like swimming pools or hot tubs may need to comply with specific health and safety regulations.

- Hosts are responsible for ensuring their properties meet all fire safety standards, including having working smoke alarms and carbon monoxide detectors.

- Short-term rental properties must not cause nuisance or disturbance to neighbors, and hosts may be held liable for any issues caused by guests.

By understanding and complying with these licensing requirements and regulations, short-term rental hosts in Nottingham can operate legally and avoid potential fines and penalties. As the market continues to evolve, it's important to stay informed of any policy changes that may impact your business.

Required Documents for Nottingham Short-Term Rentals

To operate a short-term rental in Nottingham, you will need to ensure you have the following documents in order:

- Gas Safety Certificate: If your property has any gas appliances, you must arrange for an annual gas safety check to be carried out by a Gas Safe registered engineer. You must provide a copy of the gas safety certificate to your guests before they check-in.

- Energy Performance Certificate (EPC): All rental properties in England and Wales must have a valid EPC, which provides information about the property's energy efficiency. EPCs are valid for 10 years and must be obtained from an accredited domestic energy assessor.

- Electrical Installation Condition Report (EICR): Landlords are required to ensure the electrical installations in their rental properties are safe. An EICR must be carried out by a qualified electrician at least every 5 years.

- Furniture and Furnishings (Fire Safety) Regulations: All furniture and furnishings provided in the rental property must comply with the relevant fire safety regulations. Look for appropriate labels on items to ensure compliance.

- Legionella Risk Assessment: Landlords are responsible for assessing and controlling the risk of Legionella bacteria in the property's water systems. A risk assessment should be carried out by a competent person and reviewed regularly.

- House in Multiple Occupation (HMO) Licence: If your property is shared by 3 or more unrelated people, it may be considered an HMO and require a license from the Nottingham City Council. HMOs within the council's additional licensing areas must be licensed.

- Planning Permission: If you have made any structural changes to your property or changed its use (e.g. from residential to commercial), you may need to obtain planning permission from the council.

- Insurance: While not legally required, it is highly recommended to have appropriate insurance coverage for your short-term rental property, including public liability insurance and contents insurance.

By ensuring you have all the necessary documents and permissions in place, you can operate your short-term rental in Nottingham with confidence and in compliance with local regulations. The Nottingham City Council's website provides detailed guidance for landlords on meeting their legal obligations.

Nottingham Short-Term Rental Taxes

As a short-term rental host in Nottingham, it's important to understand your tax obligations. Here is an overview of the key taxes that may apply to your rental business:

Income Tax

All rental income earned from your short-term rental property is subject to income tax. The amount of tax you'll owe depends on your total taxable income and corresponding tax band:

- Basic rate: 20% tax on income between £12,571 to £50,270

- Higher rate: 40% tax on income between £50,271 to £150,000

- Additional rate: 45% tax on income over £150,000

However, you may be eligible for certain tax reliefs and allowances:

- Rent-a-Room scheme: If you rent out a room in your main home, you can earn up to £7,500 per year tax-free under the Rent-a-Room scheme.

- £1,000 property allowance: If your total rental income is less than £1,000 per year, you don't need to declare it or pay tax on it.

National Insurance

If your short-term rental business is considered a trade (e.g. you offer additional services like meals or cleaning), you may need to pay Class 2 and Class 4 National Insurance contributions on your rental profits.

Value Added Tax (VAT)

If your total business turnover (gross rental income) exceeds £85,000 per year, you must register for VAT. The standard VAT rate of 20% would then apply to your rental income.

Council Tax

If your property is available for short-term lets for 140 days or more per year, it will be valued for business rates rather than Council Tax. However, if the property is available for less than 140 days, you will be liable for Council Tax payments.

Deductions and Allowances

To reduce your tax bill, you can deduct allowable expenses from your rental income. Allowable expenses are costs incurred wholly and exclusively for the purpose of renting out the property. These include:

- Utility bills, council tax, insurance

- Maintenance, repairs, cleaning costs

- Advertising fees, property management fees, accountant fees

- Replacing domestic items like furnishings and appliances

You can also claim capital allowances for items you buy to furnish your rental property, such as beds, sofas, and kitchen appliances.

It's advisable to keep detailed records of all income and expenses related to your rental business. If you're unsure about your specific tax situation, consult a qualified accountant or tax professional for personalized advice.

By understanding your tax obligations and leveraging available deductions, you can optimize your short-term rental business while staying compliant with HMRC regulations. With the short-term let market continuing to grow in Nottingham, it's an exciting time to be a host in this vibrant city.

England Wide Short-Term Rental Rules

In addition to local regulations in Nottingham, short-term rental hosts must also comply with national laws and requirements that apply across England. Here are some of the key proposals and changes on the horizon:

Planning Permission Changes

In February 2024, Housing Secretary Michael Gove announced reforms to planning rules in England to give local councils more control over short-term lets. Under the changes, which are expected to take effect in summer 2024:

- Planning permission will be required to convert a property that is not a host's main home into a short-term let.

- Existing short-term lets will automatically be placed into a new "short-term let" use class and will not require a planning application.

- Homeowners can still rent out their primary residence for up to 90 nights per year without needing planning permission.

National Registration Scheme

The government also plans to introduce a mandatory national registration scheme for short-term lets in England. This will:

- Require all short-term let properties to be registered with the local council.

- Provide councils with data on short-term lets in their area to help them monitor impacts on communities and ensure compliance with health and safety rules.

- Not apply "disproportionate" regulation on hosts who only let out their property occasionally. The government is still determining how the scheme will be implemented.

90-Day Limit in London

Since 2017, short-term lets of entire homes in London have been limited to a maximum of 90 nights per calendar year, unless the host obtains planning permission. This rule does not currently apply to the rest of England but could be extended in the future.

Tax Obligations

Short-term rental income is subject to income tax, which hosts must declare to HMRC. Hosts may be eligible for certain tax reliefs and allowances:

- £7,500 tax-free Rent-a-Room relief if renting out a room in a main home

- £1,000 tax-free property allowance if total rental income is under £1,000

- Claiming rental expenses like utility bills, cleaning fees, and replacements

Health and Safety

Hosts have a duty of care to ensure their property is safe for guests. Key obligations include:

- Conducting regular gas safety checks

- Ensuring electrical equipment is safe

- Fitting smoke alarms and carbon monoxide detectors

- Complying with fire safety regulations

While England does not yet have a comprehensive national framework regulating short-term rentals, the sector is facing increasing oversight. With a mandatory registration scheme on the horizon and new planning rules taking effect soon, hosts in Nottingham and across the country will need to stay informed of their responsibilities. By understanding and complying with these evolving regulations, hosts can avoid penalties and help support sustainable growth of the short-term let industry.

Does Nottingham Strictly Enforce STR Rules?

Based on discussions in online forums like Bigger Pockets and Reddit, it appears that Nottingham is relatively Airbnb-friendly compared to some other UK cities, but the city does enforce its STR rules when violations are reported.

One Nottingham Airbnb host shared this perspective on the Bigger Pockets forums:

"In my experience, Nottingham City Council isn't actively seeking out STRs to inspect for compliance, but they will investigate complaints from neighbors about noise, parties, parking issues, etc. As long as you're operating responsibly and within the rules, you shouldn't have major issues with enforcement. But I have heard of a few hosts getting fined for things like not having the proper HMO license."

Another host on the /r/AirBnB subreddit said:

"Nottingham is pretty relaxed about Airbnb compared to places like London or Edinburgh that have really cracked down. There's no nightly limit here, and the registration process is straightforward. I've been hosting for 3 years with no problems from the council. Just make sure you dot your i's and cross your t's on things like health and safety."

However, this doesn't mean that hosts can operate under the radar if they're not compliant with local regulations. One host cautioned:

"Don't assume that no license equals no enforcement. A friend of mine got hit with a big fine for running an unlicensed HMO masquerading as an Airbnb. Nottingham City Council does check up on complaints and has the power to inspect your property. It's not worth the risk to operate outside the rules."

So, in summary, Nottingham appears to be more Airbnb-friendly than some other major UK cities, with a generally permissive approach to STRs. Hosts are able to operate successfully when they follow the city's established rules and regulations. However, the Nottingham City Council will enforce those rules in response to complaints or discovered violations. The smart approach for hosts is to ensure they are fully compliant from the start to avoid fines and other penalties down the road.

How to Start a Short-Term Rental Business in Nottingham

If you're ready to start your own short-term rental business in Nottingham, follow these steps to ensure you're operating legally and setting yourself up for success:

- Research local regulations: Familiarize yourself with all the rules and requirements for short-term rentals in Nottingham, including planning permissions, health and safety standards, and HMO licensing. Consult the Nottingham City Council website and reach out to their housing team if you have specific questions.

- Register with HMRC: Before you start renting out your property, you must register with HMRC for Self Assessment tax returns. This will allow you to report your rental income and claim eligible expenses. Keep detailed records of all income and costs associated with your rental business.

- Obtain necessary licenses: Determine if your property requires an HMO license based on its location and occupancy. If so, apply for the license through the council's online portal. Expect to pay around £1,330 in licensing fees for a new application.

- Ensure health and safety compliance: Make sure your property meets all health and safety standards, including gas and electrical safety, fire safety, and furniture and furnishings regulations. Conduct regular checks and keep all safety certificates up to date.

- Set up your listing: Choose a platform like Airbnb or VRBO to list your property. Create an attractive listing with high-quality photos, detailed descriptions, and clear house rules. Be transparent about any quirks or limitations of your property to manage guest expectations.

- Establish pricing and policies: Research similar listings in your area to determine competitive nightly rates. Consider factors like seasonality, events, and demand when setting prices. Establish clear policies around minimum stays, cancellations, check-in/check-out times, and guest behavior.

- Automate your operations: Use tools like smart locks, noise monitors, and automated messaging to streamline your rental management. Consider hiring a cleaning service or co-host to help with turnovers and guest communication.

- Be a responsible host: Foster positive relationships with your neighbors by providing them with contact information and addressing any concerns promptly. Encourage guests to be respectful of noise levels and parking rules. Regularly inspect your property for any damage or maintenance issues.

- Stay informed of regulatory changes: Keep abreast of any updates to short-term rental regulations in Nottingham and across England. Join local host communities or online forums to stay connected and share experiences with other hosts.

By following these steps and prioritizing compliance and responsible hosting practices, you can build a successful and sustainable short-term rental business in Nottingham. While it may seem daunting at first, with careful planning and attention to detail, you can create a profitable and enjoyable hosting experience in this dynamic market.

Some additional tips for success:

- Focus on providing exceptional guest experiences to earn positive reviews and boost your listing's visibility

- Develop a strong brand identity and marketing strategy to stand out from competitors

- Continuously evaluate and optimize your pricing and occupancy rates to maximize revenue

- Reinvest a portion of your profits into property upgrades and amenities to attract higher-paying guests

- Consider offering unique experiences or packages to differentiate your listing, such as locally-sourced welcome baskets or partnerships with nearby attractions

With the short-term rental market in Nottingham continuing to grow, now is an exciting time to start your hosting journey. By staying compliant, professional, and guest-focused, you can build a thriving business and contribute positively to the local community.

Who to Contact in Nottingham about Short-Term Rental Regulations and Zoning?

If you have specific questions about short-term rental regulations or zoning requirements in Nottingham, there are several key contacts and resources available:

Nottingham City Council Planning and Building Control

For inquiries related to planning permissions, building regulations, and change of use for short-term rentals, contact the council's Planning and Building Control team:

Phone: 0115 876 4447

Email: planning@nottinghamcity.gov.uk

Web: https://www.nottinghamcity.gov.uk/information-for-business/planning-and-building-control/

Nottingham City Council Safer Housing Team

For questions about property licensing, HMO regulations, and housing health and safety standards, contact the council's Safer Housing team:

Phone: 0115 915 2020

Email: saferhousing@nottinghamcity.gov.uk

Web: https://www.nottinghamcity.gov.uk/information-for-residents/housing/private-rented-accommodation/

Nottingham City Council Community Protection

To report issues related to noise, anti-social behavior, or other disturbances caused by short-term rental properties, contact the council's Community Protection team:

Phone: 0115 915 2020

Email: cpservicedelivery@nottinghamcity.gov.uk

Web: https://www.nottinghamcity.gov.uk/information-for-residents/community/community-protection/

In addition to these official contacts, short-term rental hosts in Nottingham can also benefit from connecting with local host communities and industry groups. These can be valuable resources for networking, sharing experiences, and staying up-to-date on regulatory changes and best practices:

- Nottingham Hosts Forum on Airbnb Community Center: https://community.withairbnb.com/t5/Nottingham/bd-p/Nottingham

- East Midlands Landlords Forum on PropertyTribes: https://www.propertytribes.com/east-midlands-landlords-forum-f48.html

- Nottingham Landlords Facebook Group: https://www.facebook.com/groups/nottinghamlandlords/

By engaging with these key contacts and resources, short-term rental hosts in Nottingham can ensure they have the most accurate and current information about local regulations and requirements. Don't hesitate to reach out with any questions or concerns - these teams and communities are there to support hosts in navigating the complex world of short-term rentals.

Remember, regulations can change over time, so it's important to stay connected and informed. Regularly check the Nottingham City Council website and sign up for email updates to stay on top of any policy changes that may affect your short-term rental business. With the right resources and support network, you can thrive as a host in this exciting and dynamic market.

What Do Airbnb Hosts in Nottingham on Reddit and Bigger Pockets Think about Local Regulations?

To get a sense of how short-term rental hosts in Nottingham feel about the local regulations, I searched through relevant threads and comments on Reddit, Bigger Pockets, and Airbnb forums. Here are a few notable examples of real-life experiences and perspectives shared by Nottingham hosts:

On the /r/AirBnB subreddit, one Nottingham host expressed frustration with the lack of clear guidance from the city council:

"The rules around short-term lets in Nottingham are so vague and inconsistent. I've tried contacting the council multiple times for clarification on things like planning permission and HMO licensing, but never get a straight answer. It's maddening trying to ensure I'm fully compliant when even they don't seem to understand their own policies."

Another host on the Bigger Pockets forums shared their strategy for operating in Nottingham despite the restrictions:

"I've been hosting in Nottingham for 3 years now and have found that the key is keeping a low profile and being a responsible operator. I make sure my guests are respectful of the neighbors, I don't allow parties or events, and I keep on top of any maintenance issues. So far I've flown under the radar without any major problems from the council or unhappy residents."

However, not all hosts feel they can get by undetected. In response to a question about operating without the proper permissions, one Nottingham host cautioned:

"Don't assume that no license equals no enforcement. A friend of mine got hit with a big fine for running an unlicensed HMO masquerading as an Airbnb. Nottingham City Council does check up on complaints and has the power to inspect your property. It's not worth the risk to operate outside the rules."

Clearly, Nottingham hosts have mixed experiences when it comes to navigating the local short-term rental regulations. While some have managed to operate successfully by being responsible and keeping a low profile, others have faced challenges obtaining the necessary permissions and licenses. The lack of clear, consistent guidance from the city council seems to be a common pain point.

As the short-term rental market in Nottingham continues to grow and evolve, hosts will need to stay informed and adaptable. Engaging with the council and advocating for more transparent, streamlined policies could help create a more supportive environment for compliant short-term rentals in the city. At the same time, hosts should be prepared for potential regulatory changes that may impact their business in the future.

Disclaimer: While we here at BNBCalc strive to keep all of our city regulation guides updated and accurate with all the latest local laws, we still do not suggest using them as your sole or primary source for local regulations. We also do not recommend you rely on the third-party sources we link to or reference, and we are not responsible for any of the information on these third-party sites. These guides are for entertainment purposes only and only provide basic information and should not be considered as legal advice.

We highly recommend directly contacting the responsible parties for each city and hearing what their officials have to say. Ultimately, it's your responsibility as an investor to ensure you fully comply with the local laws, and it's best to speak with professionals before making an investment decision.

🤔 Confused? Get your vacation rental license, tax registration and inspections done for you

Get Help⚡️

Reveal any property's Airbnb and Long-Term rental profitability

Buy this property and list it on Airbnb.